Financial Liberalisation and Rural Credit in India

Financial liberalisation after 1991 damaged the formal system of institutional credit in rural India severely. It represented a clear and explicit reversal of the policy of social and development banking, and contributed in no small way to the extreme deprivation and distress of which the rural poor in India have been victims in the 1990s and later.

The papers in this volume, theoretical and empirical, examine the implications of financial liberalisation with respect to rural credit. The theoretical papers deal with the macro-economic and structural effects of neo-liberal financial policy on the rural banking system. The empirical papers, both secondary data-based and village-level case studies, show that changes in national banking policy had a rapid, drastic and potentially disastrous effect on the debt portfolios of rural households, particularly the income-poor.

Although it is clear that chronic indebtedness among the rural poor is a problem that cannot be solved by banking policy alone, and that the abolition of usury requires agrarian reform and major public investment, a decisive change in banking policy is essential for the very survival of the working people in rural India.

The contents of this volume can be found here.

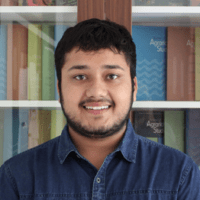

Sudha is an Administrative Assistant of the Foundation. She assists the administrative division of the Foundation and also has taken part in fieldwork organised by the Foundation.

Sudha is an Administrative Assistant of the Foundation. She assists the administrative division of the Foundation and also has taken part in fieldwork organised by the Foundation.