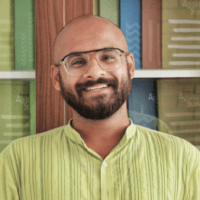

The Kerala State Planning Board appointed a Committee on November 23, 2016 to study the impact of demonetisation and related measures of the Government of India on the economy of the State of Kerala. Professor C. P. Chandrasekhar (Centre for Economic Studies and Planning, Jawaharlal Nehru University) is the Chairperson of the Committee. The other members are Professor D. Narayana (Director, Gulati Institute of Finance and Taxation), Professor Pinaki Chakraborty (National Institute of Public Finance and Policy), Dr. K. M. Abraham (Additional Chief Secretary, Finance), and Shri V. S. Senthil (Member Secretary, Planning Board).

The Government of India decided to cancel the legal-tender character of bank notes of Rs 500 and Rs 1000 denominations on November 8, 2016. This has been called “demonetisation” across the media and in addition to cancelling the legal-tender character of bank notes, the Government of India also restricted the rupee value of withdrawals by persons from Automatic Teller Machines, placed restrictions on the notes exchangeable at banks, and disallowed the banking functions of cooperative banks. The Committee’s mandate was to study the impact of these measures. The report noted that:

A number of features of Kerala’s economy have made it particularly vulnerable to the poorly planned and implemented demonetisation exercise. First, cash transactions are predominant in the State’s economy. Secondly, some of the major contributors by sector to the State’s economy are in the informal or unorganised sector, where cash transactions dominate. Millions of people in Kerala are dependent on incomes gained in the traditional sectors of fisheries, coir, handlooms, and cashew processing as well as in crop and plantation agriculture. More than two and a half million migrant workers work as wage labourers in the State. Thirdly, the three-tiered cooperative banking structure, with Primary Agricultural Credit Societies (PACS) at the bottom of the pyramid, constitutes an overwhelmingly large part of the financial structure. Fourthly, outside the financial structure, Kerala has a cooperative sector that is an important component of manufacturing and services activity, since manufacturers and service organisations banks substantially with the cooperative banking sector. Fifthly, earnings from tourism constitute an important share of Kerala’s State income. Lack of access to cash deals a blow to tourism. Sixthly, remittances play an important part in Kerala’s economy, and the economic constraints caused by the present policy can cause disruption in the flow of remittances. These features, inter alia, contribute to the intensity of the impact of the demonetisation on the state’s economy and its people.

The full text of the interim report by the Committee can be accessed here.

Sudha is an Administrative Assistant of the Foundation. She assists the administrative division of the Foundation and also has taken part in fieldwork organised by the Foundation.

Sudha is an Administrative Assistant of the Foundation. She assists the administrative division of the Foundation and also has taken part in fieldwork organised by the Foundation.